NDX Momentum

Philosophy – As a risk factor, momentum is one of the longest recognized and most researched phenomena in financial literature. If you want to try and peg a simple description, you could do worse than understanding “A body in motion tends to stay in motion, unless acted upon by some outside force.” You may recognize this as Newton’s first law of motion. In the case of momentum factor investing, the law does not apply due to physics but because of psychology. Investors like to buy things that are going in a direction that favors them. So when they see a stock going up for a while, they assume it will continue to rise (at least in the near term). This is an exploitable but not perfect market anomaly that can be used to identify and own stocks that are going up. Additionally, Stone Barn measures relative momentum and select those stocks who are moving most forcefully to the upside.

Methodology – Each month the 100 stocks in the Nasdaq 100 Index (NDX) are evaluated using a multivariate measure of their momentum both absolute and relative to each other. Once ranked according to the proprietary metric developed by Stone Barn, several are chosen as candidates for ownership. When an opening in the roster occurs, the top-ranked unowned stock is added to the portfolio. Weak stocks that have fallen out of the top rankings are sold to create the openings for newly identified movers.

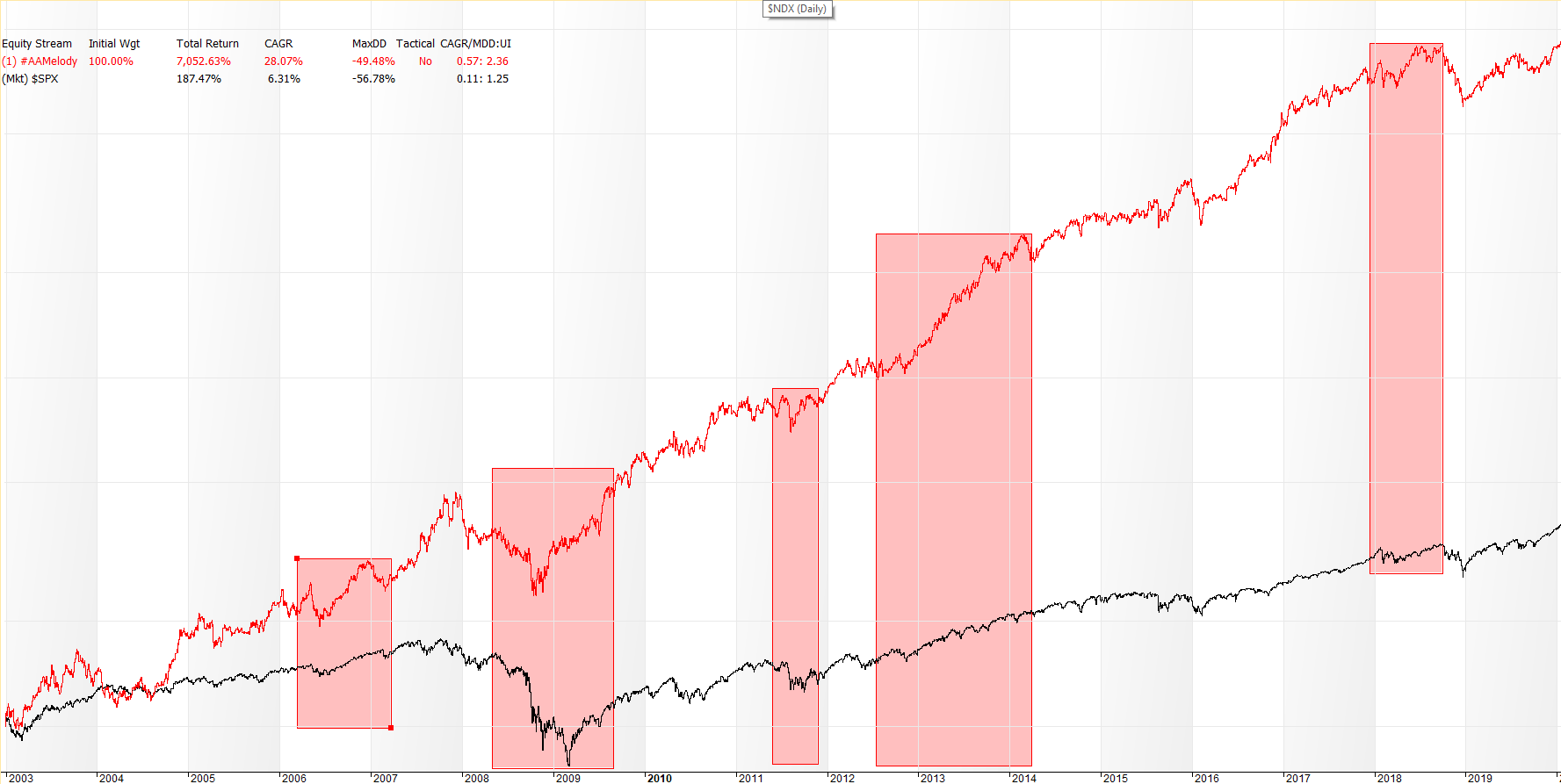

Characteristics – Since no filtering or tactical overlay is applied to the strategy itself, it remains fully invested at all times. As you can see below, this makes for a very volatile approach to investing. Returns are significant but risk of capital loss is also high. This is likely not a strategy to be used by any investor as a stand alone portfolio. The main strengths of the the strategy are that it tends to explode off market bottoms earlier and more significantly than the market itself. Secondly, it tends to significantly outperform market indices during periods of market strength. Its weakness is that it gives much of its gain back during periods of market weakness. Therefore, it is valuable in a portfolio when its allocation is paired with complementary strategies and/or its downside risk can be effectively hedged during times of greatest vulnerability. Because Stone Barn Portfolios allocate judiciously and utilize hedging techniques, this strategy is an important component in the portfolios.