NDX Low Volatility

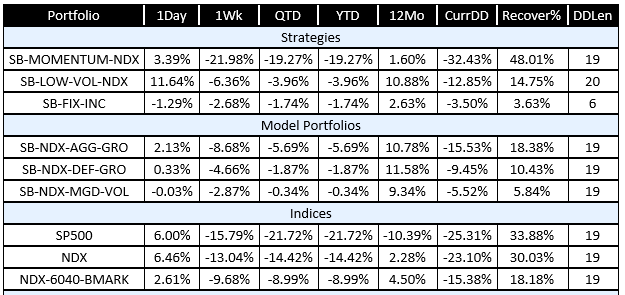

Philosophy – As a risk factor, volatility has been a long recognized contributor to overall portfolio returns. It has been, however, the red-headed step child of investing and mostly ignored until the past decade or so. Since then several papers have contributed to a greater interest in how this factor can be used to add alpha to a portfolio without adding additional risk. It has been shown, contrary to accepted wisdom, that lower volatility risk can produce higher returns. The way this works is simple math. See the table below which has a column that deserves particular attention.

This table is something that the Old Guys review every morning. At the time this table was generated the SP500 and most other indices are in bear market territory. Look at the column marked “CurrDD”. This is the current draw down (percent below most recent high) for the strategies, portfolios, and some index benchmarks. Next to that column is one labeled “Recover%.” This it the crux of low volatility investing. Notice the SB-LOW-VOL-NDX line, second from the top under the heading “Strategies” Currently the strategy is approximately 13% below its most recent high. To get back to that high, the Recovery % return is about 15%. Now look at the SP500 the first line under the heading “Indices.” It is currently 25% off its high. To get back to that high, it must have a recovery return of 34%.

Now which is more achievable and more likely. a 15% return to even or a 34% return to even. Since low volatility tends to lose less than the broad market, it does not need nearly the return on the upside to keep making more money for the investor. It seems simple, but is a too often overlooked factor in investing.

Methodology – Each month the 100 stocks in the Nasdaq 100 Index (NDX) are evaluated for volatility using a price normalized metric that measures absolute volatility over the recent past. After ranking the stocks based on the volatility from low to high, several stocks are selected as candidates for ownership. They are purchased when another currently owned issue falls out of favor in the rankings. The unique feature of the Stone Barn Low Volatility strategy is that the strategy is designed with a parameter we call “MAV”, Maximum Acceptable Volatility. If a stock exceeds the MAV that is set for the strategy it is dropped as a candidate for selection. This controls for periods when a stock may have the lowest volatility in the selection universe, but still be too volatile to use for volatility control.

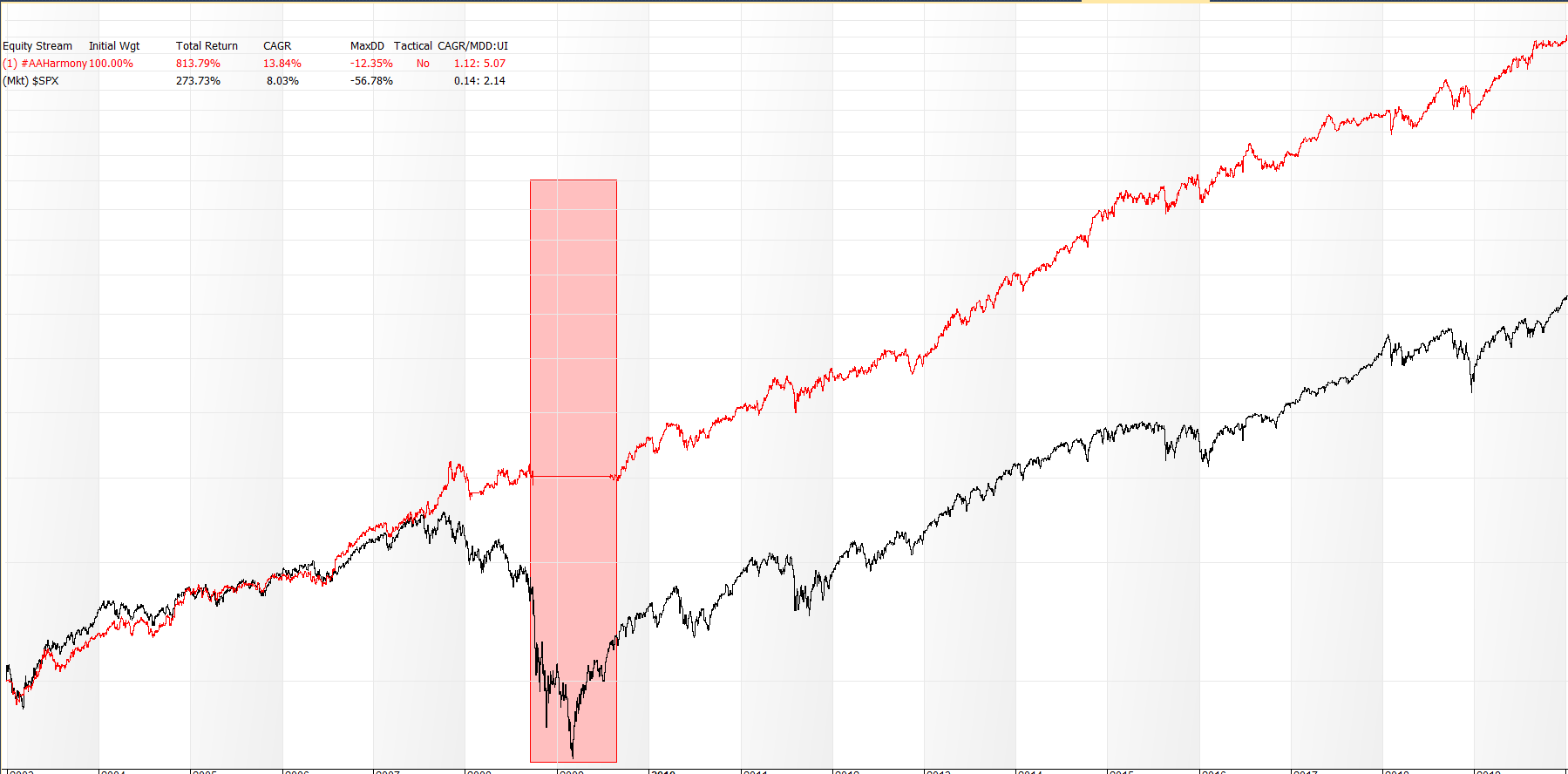

Characteristics – With its MAV feature, the strategy controls fairly well for risk during periods of drastic market weakness. It can be used as a stand-alone strategy in a portfolio but works best when paired with Momentum which picks up the slack when Low Vol is hesitant to return to full allocation. In the chart below you can see well during the financial crisis months that Low Volatility went to cash during this time.