Fixed Income Strategy

Philosophy – It doesn’t take most investors very long to realize that pairing equity assets with fixed income assets produces a much smoother return stream than equities alone and a much better return than fixed income alone. At Stone Barn we create our own fixed income asset class by select 2 bond ETF’s each month and holding them at various weightings based on their relative performance. To us, the fixed income strategy is not for growth or return. It is there to provide a buffering effect on the other strategies in any given portfolio.

Methodology – Each month we evaluate a universe of Fixed Income ETF’s including Long and Short Term corporate and government funds as well as those based on mortgages, and other interest rate sensitive sectors of the markets (excluding preferred stocks). From this universe we select 2 funds and weight them according to their relative strength. We find that owning 2 funds is better than a single fund or several funds.

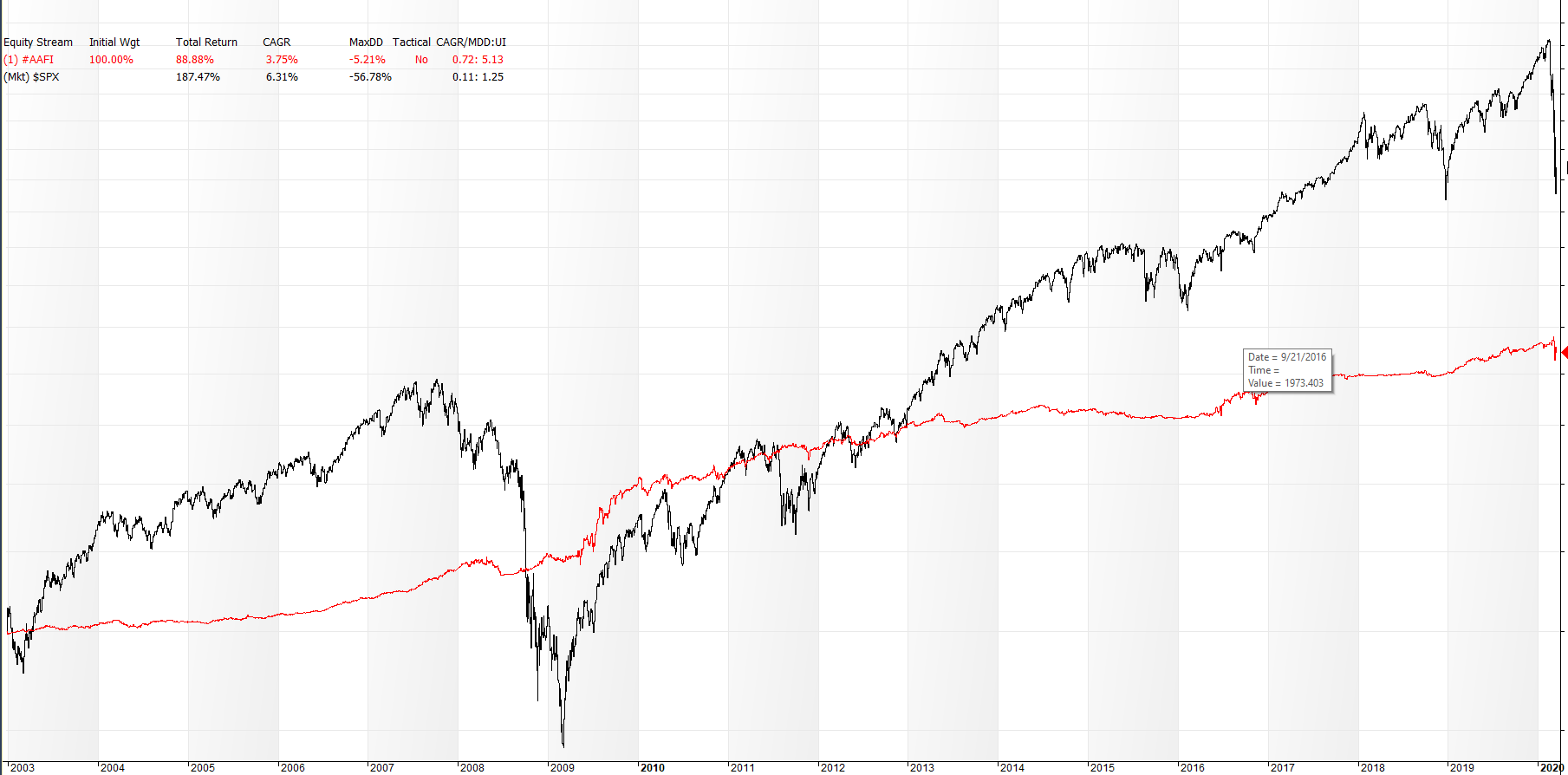

Characteristics – The idea of the Fixed Income Strategy is to provide a consistent return stream with limited downside risk. See the return stream in the chart below as it relates to the SP500 over time.